gvox

Ghost of Love

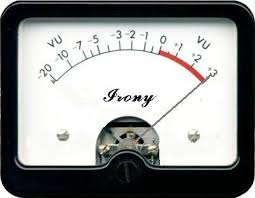

Specifically designed with U2 in mind, most likely.

.

.

Also, they are not cheaters or tax evaders. Is Bono in jail with Wesley Snipes? Is Edge working on a new rap mix of Mysterious Ways with the gangsta rappers? Is Adam lamenting the lack of poshness in the prison jumpsuits while otherwise having a great time? Is Larry working out in the prison gym?

You make no sense all around.

Get real.

I never once said anything about this being related to publishing, in fact myself and others have repeatedly said these are different portions of their income. I also never said anything about being taxed to the hilt or that this was unfair. The point was that they do indeed pay taxes all over the world, and you were pretending like they don't.

I never once said anything about this being related to publishing, in fact myself and others have repeatedly said these are different portions of their income. I also never said anything about being taxed to the hilt or that this was unfair. The point was that they do indeed pay taxes all over the world, and you were pretending like they don't.