MadelynIris

Refugee

I GET 0!

hmpfff!

Whatever.

hmpfff!

Whatever.

deep said:I'm going to the fertility clinic and grab me up some frozen fetuses

oops, I mean human beings

martha said:Damn!I knew not having kids would make me a loser some day.

martha said:I was thinking about this last night: Are those idiots going to tax this as well? You know, like they tax my state tax refund?

paying for a war.

paying for a war.martha said:So they're gonna tax me on my "tax rebate."

Huckabee

"We'll probably end up borrowing this $150 billion from the Chinese, and when we get those rebate checks,

most people are going to go out and buy stuff that's been imported from China."

toscano said:

bad governement, giving me free money and all.....bad bad bad

martha said:

Free money?? Yeah, this is "free money."

That deficit is just pretend. :fairies:

toscano said:

If your priniciples are that strong I can give you some good places to donate your refund

Bluer White said:Spending to stave off a deep recession will leave the deficit in better shape in the long run.

financeguy said:Ntwalwar, I am deeply concerned about that graph I am going to post that on a forum with some economists on it to find out what they say.

Vincent Vega said:

Could you link to that or summarize what they have to say?

I'm certainly interested, too, what they have to say, and would like to get a grasp on how good my own conclusions are.

Vincent Vega said:An interesting question would also be: Which bank, or banks, is/are the US's Northern Rock, i.e. which bank will be the first customers lose trust in.

financeguy said:

Already happened with Countrywide surely?

deep said:

all deposits in banks are insured by:

FDIC: Federal Deposit Insurance Corporation

Federal deposit insurance protects the first $100000 of deposits that are payable in the United States.

Vincent Vega said:

Could you link to that or summarize what they have to say?

I'm certainly interested, too, what they have to say, and would like to get a grasp on how good my own conclusions are.

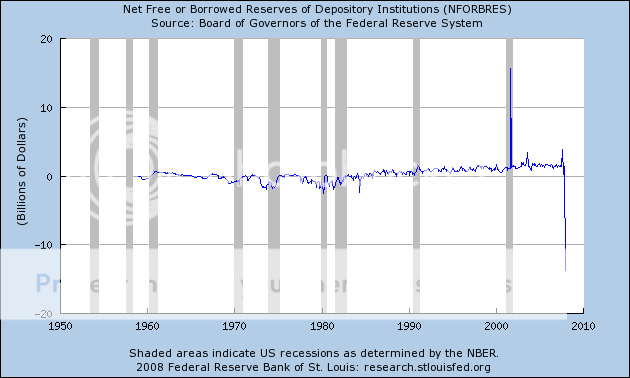

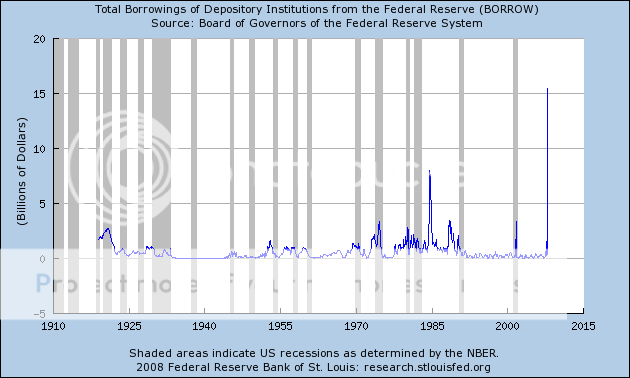

"This shows the reserve position of the US Depositors institutions (banks to you and me).

http://www.federalreserve.gov/releases/h3/Current/

What it is showing is the banking sector suffered a large losses and needed to call on Fed bail out to meet reserve requirements. No surpise there:

http://www.npr.org/templates/story/story.php?storyId=18106269

In order to meet their reserve requirements, they go to the Fed to borrow. But cost is punitive, so they will look to recapitalise, reduce their balance sheet etc. as required to unwind this.

This is a significant sum, but we know about it already - Citigroup alone took a €10bn earning hit last quarter, which would have severely affected their ability to maintain required reserve ratios without liquidating their assets.

This is not good, but we did at least know this already. And Citi are recapitalising so we should see this unwind (keep the link and you can follow by the month).

But it does show the mechanics of "debt deflation". Imagine if Citi couldn't recapitalise, they would need to sell down their balance sheet. Asset prices would fall as the bank scramble to meet reserve requirements. This would impact other banks and they do the same. No banks would be willing to lend, all would be lookng to reduce their lending and increasing their reserve holdings. And that is the story of Japan. When this happens in earnest, it doesn't matter how low interest rates are, bank won't want or be able to lend."

sue4u2 said:Not putting it in savings at the moment since interest rates are falling.

Vincent Vega said:

I figured it would get hard to ask banks for loans, and well, banks won't lend each other.