Housing Woes in US Spread Around Globe

by MARK LANDLER

New York Times, April 14

DUBLIN — The collapse of the housing bubble in the United States is mutating into a global phenomenon, with real estate prices swooning from the Irish countryside and the Spanish coast to Baltic seaports and even parts of northern India. This synchronized global slowdown, which has become increasingly stark in recent months, is hobbling economic growth worldwide, affecting not just homes but jobs as well. In Ireland, Spain, Britain and elsewhere, housing markets that soared over the last decade are falling back to earth. Property analysts predict that some countries, like [Ireland], will face an even more wrenching adjustment than that of the United States, including the possibility that the downturn could become a wholesale collapse.

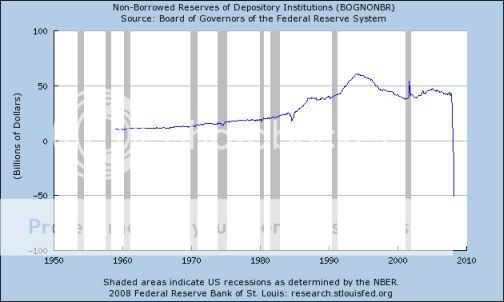

To some extent, the world’s problems are a result of American contagion. As home financing and credit tightens in response to the crisis that began in the subprime mortgage market, analysts worry that other countries could suffer the mortgage defaults and foreclosures that have afflicted California, Florida and other states. Citing the reverberations of the American housing bust and credit squeeze, the International Monetary Fund last Wednesday cut its forecast for global economic growth this year and warned that the malaise could extend into 2009. “The problems in the US are being transmitted to Europe,” said Michael Ball, professor of urban and property economics at the University of Reading in Britain, who studies housing prices. “What’s happening now is an awful lot more grief than we expected.”

For countries like Ireland, where prices were even more inflated than in the United States, it has been a painful education, as homeowners learn the American vocabulary of misery. “We know we’re already in negative equity,” said Emma Linnane, a 31-year-old university administrator. She bought a cozy, one-bedroom apartment in the Dublin suburbs with her fiancé, Paul Colgan, in May 2006, at the peak of the market. They paid $575,000—at least $100,000 more than it would fetch today. “I sometimes get shivers thinking about it,” Ms. Linnane said, “but I’ll let the reality hit me when I go to sell it.”

That reality is spreading. Once-sizzling housing markets in Eastern Europe and the Baltic states are cooling rapidly, as nervous Western Europeans stop buying investment properties in Warsaw, Tallinn, Estonia and other real estate Klondikes. Further east, in India and southern China, prices are no longer surging. With stock markets down sharply after reaching heady levels, people do not have as much cash to buy property. Sales of apartments in Hong Kong, a normally hyperactive market, have slowed recently, with prices for mass-market flats starting to drop. In New Delhi and other parts of northern India, prices have fallen 20% over the last year. Sanjay Dutt, an executive director in the Mumbai office of Cushman & Wakefield, the real estate firm, describes it as an erosion of confidence.

Much of the retrenchment seems to be following the basic law of gravity: what goes up must come down. With low interest rates helping to inflate housing bubbles in many countries, economists said the confluence of falling prices was predictable, if unsettling. This is not the first housing downturn to cross borders, but its reverberations have been amplified by the integration of financial markets. When faulty American mortgages end up on the books of European banks, the problems of the United States aggravate the world’s problems.

Consider Britain, which had one of Europe’s most robust housing markets, with less of an oversupply than in Ireland or Spain. Then last summer came the subprime crisis across the Atlantic. Within two months, mortgage approvals dropped 31%, compared with the previous year. And by March, average housing prices had fallen 2.5%, the largest monthly decline since 1992. “The boom in house prices was actually much bigger here than in the US,” said Kelvin Davidson, an economist at Capital Economics in London. “If anything, people should be more worried than in the US.” Britain has one of the most developed home-financing industries, not far behind that of the United States. The amount of outstanding mortgage debt, as a share of total economic output, is higher there than in the United States, according to a study by the International Monetary Fund. “The UK followed the US into never-never land, pushing mortgages out the door, believing that prices would go up forever,” said Allan Saunderson, the managing editor of Property Finance Europe, a newsletter for investors.

Still, the problems in Britain pale next to those of Spain and Ireland. Residential investment accounts for 12% of the Irish economy and 9% of the Spanish economy, compared with 5% in Britain and 4% in the United States, according to the IMF. The glut of housing has brought new construction to a standstill, driving up unemployment and dimming the prospects for two of Europe’s stellar performers over the last decade. “We’re waking up from the property dream and finding ourselves in a situation where prices are falling in Spain for the first time,” said Fernando Encinar, a founder of Idealista.com, a real estate Web site. In Spain, more than four million homes were built in the last decade, more than in Germany, Britain and France combined. Average house prices tripled in parts of the country, as Spain’s torrid economy attracted immigrants and Northern Europeans snapped up holiday homes along the Costa del Sol. Now, though, thousands of those houses stand empty. The IMF estimates that property is overvalued by more than 15%. With mortgages drying up and prices swooning, speculators who once viewed Spanish property as a no-lose proposition are confronting hard reality.

In 2005, Julian Felipe Fernandez bought three small apartments, as an investment, in a huge development being built outside Madrid. He paid 100,000 euros as a deposit for the units, and now he is eager to sell them to avoid having to taking on a costly mortgage. But with the market stalled, Mr. Fernandez’s asking price is what he paid for them. “Three years ago, it looked like I would be able to flip them for a nice profit before they were finished,” he said. “I just want to get them off my hands, to get rid of this headache.” If he unloads them, he will be lucky. Enric Bueno, head of marketing for Ibusa, a real estate company in Barcelona, said his firm was closing six or seven sales a month, compared with 40 a month a year ago. “Things are really bad,” Mr. Bueno said. “If this goes on for five years, we won’t make it.” Economists have been busy cutting their growth forecasts for Spain, with a few saying that it may stagnate this summer. BBVA, a leading Spanish bank, forecasts that unemployment will rise to an average of 11% this year, from 8.6% in 2007.

Such cutbacks are well under way in Ireland, where the taxi drivers complain that their ranks are being swollen by laid-off home builders. The housing collapse has brought an abrupt end to more than a decade of pell-mell growth that earned Ireland the nickname “the Celtic tiger.” Today, the mood in this country feels like a wake, and not an Irish one. Average house prices fell 7% last year, the most in Europe, according to the Royal Institution of Chartered Surveyors, a British real estate group. They are likely to fall by a similar amount this year. After a 16-year boom that was interrupted only briefly after the Sept. 11 terrorist attacks, Ireland has the most overvalued housing market among developed countries, according to the IMF. In its recent economic outlook, the fund calculated that prices are 30% higher than they should be, given Ireland’s economic fundamentals.

For many Irish, accepting that reality is like passing through the seven stages of grief. Some homeowners are still in denial, brokers said, asking $5 million for houses worth no more than $4 million. But developers have begun cutting prices for smaller apartments like the one owned by Emma Linnane. “Last year was our ‘wake up in the middle of the night with sweat pouring down your face’ period,” said David Bewley, a director at the Lisney real estate agency. “Now we’ve grown up.”

Not all the omens are negative. Mr. Bewley said houses were selling again, albeit for 25% less. Ireland has not yet suffered widespread incidences of defaulting mortgages or foreclosures in this downturn, in part because lenders have not been as aggressive as those in the United States. But some worry that the housing meltdown could spoil Ireland’s recipe for success. Like Spain, it attracted lots of foreign workers, many of whom came for well-paying jobs in the construction industry. That fueled the Irish rental market, which has remained buoyant and been a source of income for Ireland’s many real estate speculators. “If the immigrants go back home, will this hurt the rental market?” asked Ronan O’Driscoll, a director in the Dublin office of Savills, a real estate firm. “If that happens, it would definitely cause foreclosures.”