You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

United States of Entropy Part 2

- Thread starter Pearl

- Start date

The friendliest place on the web for anyone that follows U2.

If you have answers, please help by responding to the unanswered posts.

If you have answers, please help by responding to the unanswered posts.

Read that earlier, gentleman is one of the heads of a prominent hedge fund. The self-entitlement on display is nauseating. He obviously lives in a parallel reality, disdainful of those around him.

I really don't want to live in a world where 85 people own more than 3.5 billion do. There is no 'freedom' present in this situation.

I really don't want to live in a world where 85 people own more than 3.5 billion do. There is no 'freedom' present in this situation.

An interesting study places a significant portion of the increase in income inequality in the United States on a combination of (a) the tendency for men and women of high earning potential to marry each other and (b) for them to form two-income households, as compared to the 60s when earning potential was (according to the study) a less important factor in marriage and women of all classes were less likely to work. The study claims that this can account for all (!) of the increase in America's Gini coefficient since 1960, although I disagree with its metric for saying that. And I think it does little to explain the large increase in inequality since about 2007 (although that was the trend up to 2007 as well).

Did Women's Lib Cause Rising Income Inequality? - Bloomberg

Did Women's Lib Cause Rising Income Inequality? - Bloomberg

This is very questionable analysis. You should look at wage distribution for all workers. This shows inequality more than anything else and has nothing to do with household income or "assortative mating." Could there be some impact from women's liberation on income inequality? Yes, but I don't think it's as pronounced as this article makes it seem.

I would think the effect they are identifying is the following:

The difference between 1) the probability that a woman works today and 2) the probability that a woman worked 50 years ago, is positively correlated with that women’s education level. So, for example, a large % of women that graduated from university in 1950 didn’t work (they raised their children), while today they do work. In contrast, women that didn’t go to university didn’t see as large a change in their probability of working.

I would think the effect they are identifying is the following:

The difference between 1) the probability that a woman works today and 2) the probability that a woman worked 50 years ago, is positively correlated with that women’s education level. So, for example, a large % of women that graduated from university in 1950 didn’t work (they raised their children), while today they do work. In contrast, women that didn’t go to university didn’t see as large a change in their probability of working.

The Scary Reality of Americans' Retirement SavingsIt’s not exactly news that Americans’ overall retirement savings are greatly amiss. But the actual magnitude of that disconnect between what we know we’re supposed to save and how much we’re actually putting away is shocking.

A new study by the National Institute on Retirement Security spells out this shortfall in scary-low numbers, and finds that with the median retirement account at a mere $3,000, the average American working family has virtually zero retirement savings

Those nearing retirement are no better off. When the study focused on just the demographic approaching that benchmark (people age 55 to 64), they found that less than 5% had savings that were on track to meet standard targets. All in all, the report calculates that the national savings gap could tally up to $14 trillion.

What Does This Mean for the Future?

The study pinpoints the savings shortage on more than just the recent economic crisis, also noting that only half of private employees today are offered retirement benefits through their employer—that’s the lowest it’s been since 1979, and is likely compounding the problem.

Without some improvement, the study suggests that the country is setting itself up for heavy dependence on public assistance, younger generations and social service organizations to help with the future retirement burden. “The ‘American Dream’ of retiring after a lifetime of work will be long delayed, if not impossible, for many,” according to the report. Perhaps this could be a wake-up call to save more for retirement.

U.S. Ranks 19th in Retirement SecurityThe United States may have placed second at the Winter Olympics, but when it comes to retirement, America isn’t winning any medals.

In fact, a new report by Natixis Global Asset Management finds that the U.S. ranks a paltry 19th place in retirement security across the globe. That means that the nation falls far behind many other developed countries—like Germany, Canada, Iceland and Korea.

While we’ve reported before on the scary reality of Americans’ retirement savings, The Global Retirement Index is based on more than just money; the ranking takes into account a number of qualities that affect citizen’s golden years, including health care, finances, material well-being and general quality of life.

So what’s dragging the U.S. down? As CNNMoney notes, high-ranking countries like Switzerland, which came in first overall, support strong pension systems—while in the U.S., you’re largely on your own when it comes to socking away enough funds for retirement. And while countries like Austria, which placed third in the report, have first-rate universal health care systems, many U.S. retirees still struggle with steep health care costs.

“The responsibility for financial security in retirement is falling even more heavily on individuals than ever before,” John T. Hailer, C.E.O. of Natixis Global Asset Management in the Americas and Asia said in a press release. “It is becoming increasingly apparent that to ensure financial security in retirement, individuals need to set personal goals and view planning and saving for retirement as a serious, conscious and strategic pursuit.”

I really have a bleak outlook on the future of this country. Our greed and love affair with Keeping Up with the Jones' will ruin us. Many of us sneer at government/social programs, insist on living beyond our means just to compete with the neighbors, and the powers that be make finding a good paying job harder, refuse to raise the minimum wage (yes, I'm aware of the recent study that says raising the wage to $10 could cost thousands their jobs, so its damned if you do, damned if you don't), and many other problems. Our national debt is insane and won't go away for many decades, if ever. Companies are very reluctant to hire anyone 50 years and over, leaving that age group with low salaries while they struggle to pay their mortgage and help their kids with insane college tuition as much as they can. Too bad that tuition is through the roof, leaving graduates struggling to pay it off for years while they are unable to really save up for retirement. And let's not get started on how offensively expensive health care is here compared to other countries - and we're still not as healthy as those places are.

Yep. We're friggin' screwed.

OK, so about that deficit...

http://www.nytimes.com/2014/02/28/b...-falls-to-smallest-level-since-2008.html?_r=0

This is good news, and a bit of a relief here. Not only are we slowly recovering from the Great Recession, but also from our deficit. It takes time, but hopefully we are going in the right direction.

WASHINGTON — The federal budget deficit fell precipitously to $680 billion in the 2013 fiscal year from about $1.1 trillion the year before, the Treasury Department said Thursday. That is the smallest deficit since 2008, and marks the end of a five-year stretch when the country’s fiscal gap came in at more than a trillion dollars a year.

The report comes days before the White House is expected to release a new budget.

Democrats have said that the still-tepid recovery requires government investment along with commitments to reduce deficits in the long term — while also emphasizing the rapidly falling budget gap.

Republicans have long said that Democrats have proven poor stewards of the economy, overseeing a period of sluggish growth and rising debt.

The report, which was a regular update on the country’s finances, underscores the persistence, if not the strength, of the recovery after the worst economic downturn since the Great Depression. Growth in tax revenue accounts for much of the decline in the deficit. But increases in taxes and cuts in federal spending figure strongly too, as does a surprising — and surprisingly long — slowdown in the pace of health-spending growth.

The Treasury said that revenue climbed $324 billion to $2.8 trillion between 2012 and 2013. That is growth of around 12.9 percent, reflecting both higher income rates, including higher top marginal rates and the expiration of the payroll tax holiday, and a strengthening economy.

At the same time, government spending grew relatively slowly, to $3.9 trillion from $3.8 trillion a year earlier, the Treasury said.

“Thanks to the tenacity of the American people and the determination of the private sector we are moving in the right direction,” said Treasury Secretary Jacob J. Lew in the report. “The United States has recovered faster than any other advanced economy, and our deficit today is less than half of what it was when President Obama first took office.”

http://www.nytimes.com/2014/02/28/b...-falls-to-smallest-level-since-2008.html?_r=0

This is good news, and a bit of a relief here. Not only are we slowly recovering from the Great Recession, but also from our deficit. It takes time, but hopefully we are going in the right direction.

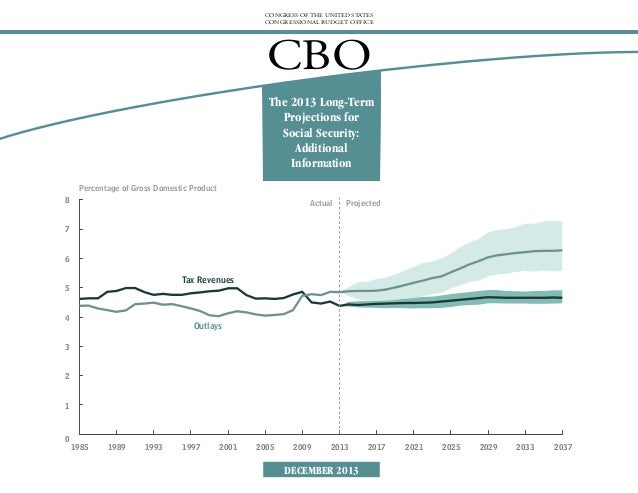

The debt is not a very big issue in the short term. But it is a fairly massive issue in the long term, because of Social Security and Medicare. I cautiously support raising the retirement age to deal with that, but that's from the perspective of a 21-year-old who presently looks at the idea of retirement with disgust.

The debt is not a very big issue in the short term. But it is a fairly massive issue in the long term, because of Social Security and Medicare. I cautiously support raising the retirement age to deal with that, but that's from the perspective of a 21-year-old who presently looks at the idea of retirement with disgust.

??

Why disgust?

Most of our financial planning is cantered around early retirement.

??

Why disgust?

Most of our financial planning is cantered around early retirement.

Disgust is probably too strong of a word. But I am a young person who enjoys being productive, and, at this point in my life, it's hard for me to imagine giving that up unless forced. My attitude is likely to change (probably once I'm out of college and working 60+ hours per week). But I'm probably less empathetic towards those who wish to retire than I should be.

Irvine511

Blue Crack Supplier

retirement should be encouraged -- spend your time volunteering, and free up your job up for someone younger. retirement doesn't have to be knitting clubs and bingo halls.

with healthcare no longer shackled to unemployment, we can potentially use our 60-and-up years to be productive in other ways. just start planning early.

i say this as a career-driven mid-30s-something with a mortgage. it will be nice to eventually ease up on the gas.

with healthcare no longer shackled to unemployment, we can potentially use our 60-and-up years to be productive in other ways. just start planning early.

i say this as a career-driven mid-30s-something with a mortgage. it will be nice to eventually ease up on the gas.

Yeah, exactly. digitize, I really do think your view is that of somebody who is a bit young.

This idea that we should take pride in working until we drop dead is really bizarre. I've done not 60 hours but 80-100 a week and you could see that as very productive, whereas looking back on it I see it as very unhealthy.

Nobody lies on their death bed and says "I wish I had spent more time at the office." Take a look at all the research about the regrets that dying people have and it becomes pretty clear.

We are healthier and live longer. You can transition into partial retirement. You can consult. You can travel the world, train to run a 10K, etc. Not going to just die down in some minimum security Floridian prison.

This idea that we should take pride in working until we drop dead is really bizarre. I've done not 60 hours but 80-100 a week and you could see that as very productive, whereas looking back on it I see it as very unhealthy.

Nobody lies on their death bed and says "I wish I had spent more time at the office." Take a look at all the research about the regrets that dying people have and it becomes pretty clear.

We are healthier and live longer. You can transition into partial retirement. You can consult. You can travel the world, train to run a 10K, etc. Not going to just die down in some minimum security Floridian prison.

Yeah, exactly. digitize, I really do think your view is that of somebody who is a bit young.

This idea that we should take pride in working until we drop dead is really bizarre. I've done not 60 hours but 80-100 a week and you could see that as very productive, whereas looking back on it I see it as very unhealthy.

Nobody lies on their death bed and says "I wish I had spent more time at the office." Take a look at all the research about the regrets that dying people have and it becomes pretty clear.

We are healthier and live longer. You can transition into partial retirement. You can consult. You can travel the world, train to run a 10K, etc. Not going to just die down in some minimum security Floridian prison.

Fair enough. My career targets would have me pulling the occasional 80-100 hour week (though hopefully I won't end up in an investment banking-like position of doing that constantly), so I'll probably feel differently eventually. My instinctual policy recommendation may not be worth as much as my instinct tells me.

Disgust is probably too strong of a word. But I am a young person who enjoys being productive, and, at this point in my life, it's hard for me to imagine giving that up unless forced. My attitude is likely to change (probably once I'm out of college and working 60+ hours per week). But I'm probably less empathetic towards those who wish to retire than I should be.

But even when you retire from your 40 hour a week job, you can still be productive. You can start a part-time venture to have an income and keep you busy. There are plenty of retirees who go into writing, painting, woodmaking (my uncle is now making dollhouses and birdhouses) and various things.

As for wishing to retire, well the majority of people despise their jobs. I think about 75% do, so who can blame them for wanting to retire so badly?

iron yuppie

ONE love, blood, life

The idea of early retirement is nice and all, but increasing lifespans mean that many people will have to work far longer than they planned or hoped. As far as I understand it, much of the unemployment problem among teens and young adults is a function of competition from senior citizens who had retired and then realized they had to go back to work.

Irvine511

Blue Crack Supplier

it stresses the importance of retirement planning, and it also stresses the importance of a government program like social security that create a floor of living standards for the elderly.

most people don't have the time or knowledge to effectively financially plan for themselves, let alone manage a stock portfolio over 30 years. it's also very difficult to get people to save for the future when the present seems so pressing. social security does both for you, and doesn't risk destroying your savings should another 2008 happen again.

most people don't have the time or knowledge to effectively financially plan for themselves, let alone manage a stock portfolio over 30 years. it's also very difficult to get people to save for the future when the present seems so pressing. social security does both for you, and doesn't risk destroying your savings should another 2008 happen again.

it stresses the importance of retirement planning, and it also stresses the importance of a government program like social security that create a floor of living standards for the elderly.

most people don't have the time or knowledge to effectively financially plan for themselves, let alone manage a stock portfolio over 30 years. it's also very difficult to get people to save for the future when the present seems so pressing. social security does both for you, and doesn't risk destroying your savings should another 2008 happen again.

Social security may have problems in the future, so it is best to not completely rely on it.

The more I learn about personal finance, the more I think it is necessary for people to be educated about it. We put on emphasis on learning and being better at sex, cooking, even makeup, but why not personal finance if that is more important than those examples (no one can live without money)? A lot of people's financial problems come from poor financial planning that can easily be learned with simple courses or just reading books by Suze Orman or Dave Ramsey. Its true that it is not easy saving up or creating emergency funds (I'm on a tight budget too, so I wish dearly that I could save more), but it can still be done, however small.

INDY500

Rock n' Roll Doggie Band-aid

it stresses the importance of retirement planning, and it also stresses the importance of a government program like social security that create a floor of living standards for the elderly.

It also, and due to demographics will increasingly, transfer income from young families raising kids and paying mortgages to retired grandpa and grandma on the golf courses of Arizona. Think people might better prepare for retirement if they had 12.4% (soc sec tax rate) of their income back?

most people don't have the time or knowledge to effectively financially plan for themselves, let alone manage a stock portfolio over 30 years.

You might be a liberal if... you think people are too lazy/stupid to attend to their own lives. Plan their retirement, buy health insurance, secure a picture ID to vote, or get through life without a government program to lead you by the hand.

it's also very difficult to get people to save for the future when the present seems so pressing.

5 years after the recession and we're saying this?

social security does both for you, and doesn't risk destroying your savings should another 2008 happen again.

2008 will look like a $20 bounced check compared to the collapse of the U.S. economy.

Irvine511

Blue Crack Supplier

It also, and due to demographics will increasingly, transfer income from young families raising kids and paying mortgages to retired grandpa and grandma on the golf courses of Arizona. Think people might better prepare for retirement if they had 12.4% (soc sec tax rate) of their income back?

i'm glad you're a big fan of immigration as well! the best way to be able to pay for an aging society is a constant influx of young, hungry immigrants ready to work and have families. hopefully, you can convince some in your party not to fear people who might be different from them and embrace immigration reform.

as for the 12.4%, no, i think that money would be spent. it's very hard to get people to plan for retirement without someone doing it for them. even your college educated, white collar workers benefit tremendously from their employer's creating 401(k)'s where the money is taken out of the paycheck before you ever see it. but large swathes of our workers aren't offered retirement plans, so it makes sense that there's a basic floor in place so that the elderly don't die in poverty like they did before FDR and then later the Great Society.

it might sound nice, but really, no on actually wants to return to the past except for people who don't know anything about it.

You might be a liberal if... you think people are too lazy/stupid to attend to their own lives. Plan their retirement, buy health insurance, secure a picture ID to vote, or get through life without a government program to lead you by the hand.

it's less about being lazy or stupid and more about not having opportunity or time or the actual knowledge to manage an investment portfolio. we all know that the elderly in particular are targeted by money scams, so it's nice that there's some protection so that you don't lose your money even if you lose your marbles. it's less about leading you by the and and more about making sure that, no matter what, you have a floor. it will be there no matter what else happens to you.

it's basic compassion, but i understand that's in short supply for some Americans.

5 years after the recession and we're saying this?

everyone has always said this all the time and always will. unless you are a couple starting to make upwards of, say, $125,000 or more, you likely still live virtually paycheck to paycheck. it's very difficult to effectively plan for the future without a plan in place. what SS does is prevent widespread senior poverty.

2008 will look like a $20 bounced check compared to the collapse of the U.S. economy.

i'm all for raising the retirement age, but this kind of scare mongering is just silly.

PhilsFan

Blue Crack Addict

You might be a conservative if you think the only explanation for anything negative is laziness or stupidity. And maybe not, say, being really busy because you're working multiple jobs for shit pay.You might be a liberal if... you think people are too lazy/stupid to attend to their own lives. Plan their retirement, buy health insurance, secure a picture ID to vote, or get through life without a government program to lead you by the hand.

i'm glad you're a big fan of immigration as well! the best way to be able to pay for an aging society is a constant influx of young, hungry immigrants ready to work and have families. hopefully, you can convince some in your party not to fear people who might be different from them and embrace immigration reform.

I'm very strongly pro-immigration, but it's impossible to permanently base funding entitlement programs off of a steady stream of immigrants.

Irvine511

Blue Crack Supplier

I'm very strongly pro-immigration, but it's impossible to permanently base funding entitlement programs off of a steady stream of immigrants.

Agreed, but it sure helps keep the population younger than it would be.

INDY500

Rock n' Roll Doggie Band-aid

The math always catches up to a Ponzi scheme.

U2DMfan

Rock n' Roll Doggie VIP PASS

I read that if we'd just raise the cap on the SS tax, it would comfortably solve the problem. Hell, it's so easy, you know it will never happen.

Mostly because Grover Norquist has half of American Government by the balls. Why? Because he can defeat those politicians in primaries and that's all the politicians care about - staying if office. And Norquist does it by working on behalf of the super rich, under the guise of keeping taxes low for everybody (that's the plausibly denied politics of it) and "small government". Yes, Norquist, hired by Ronald Reagan, the effective founder of modern Big Government conservatism. All the while continuing to keep millions upon millions of Americans voting against their own best interests, while using political ploys to frame everything as Us vs Them, Makers vs Takers and so on.

Mostly because Grover Norquist has half of American Government by the balls. Why? Because he can defeat those politicians in primaries and that's all the politicians care about - staying if office. And Norquist does it by working on behalf of the super rich, under the guise of keeping taxes low for everybody (that's the plausibly denied politics of it) and "small government". Yes, Norquist, hired by Ronald Reagan, the effective founder of modern Big Government conservatism. All the while continuing to keep millions upon millions of Americans voting against their own best interests, while using political ploys to frame everything as Us vs Them, Makers vs Takers and so on.

U2DMfan

Rock n' Roll Doggie VIP PASS

Sorry, I just can't resist.

If you can fund it (not that they are, but that they can), it's not a Ponzi scheme.

If you don't like it only because decades of cynical politics has somehow convinced you that it's a bad thing, then it's a "Ponzi Scheme". Although that makes no sense, but why would it need to make any sense?

It's nothing more than a 'good line' to use in a bullshit partisan argument. That's why the political hack that came up with it started using it in the place. It doesn't have to make sense, it just has to be a good barb.

The math always catches up to a Ponzi scheme.

If you can fund it (not that they are, but that they can), it's not a Ponzi scheme.

If you don't like it only because decades of cynical politics has somehow convinced you that it's a bad thing, then it's a "Ponzi Scheme". Although that makes no sense, but why would it need to make any sense?

It's nothing more than a 'good line' to use in a bullshit partisan argument. That's why the political hack that came up with it started using it in the place. It doesn't have to make sense, it just has to be a good barb.

INDY500

Rock n' Roll Doggie Band-aid

Sorry, I just can't resist.

If you can fund it (not that they are, but that they can), it's not a Ponzi scheme.

If you don't like it only because decades of cynical politics has somehow convinced you that it's a bad thing, then it's a "Ponzi Scheme". Although that makes no sense, but why would it need to make any sense?

It's nothing more than a 'good line' to use in a bullshit partisan argument. That's why the political hack that came up with it started using it in the place. It doesn't have to make sense, it just has to be a good barb.

It spends more than it receives in revenue.

There is only an IOU in the Social Security "lockbox."

The unfunded liability of Soc sec is $10 trillion.

Run a pension plan like that in the private sector and you'd be in jail.

And Europe faces the same demographic problem of funding its Welfare state.

INDY500

Rock n' Roll Doggie Band-aid

I read that if we'd just raise the cap on the SS tax, it would comfortably solve the problem. Hell, it's so easy, you know it will never happen.

Of course, higher and higher taxes. It's so easy.

Irvine511

Blue Crack Supplier

Of course, higher and higher taxes. It's so easy.

Present taxes are at historic lows.

It's difficult to take seriously a party that spent 8 years starting wars and gutting revenues via tax breaks for the wealthy to then act as if they know anything about fiscal responsibility.

Let's talk about Obama's tumbling deficits and the Clinton surpluses and the 1990s tax rates.

U2DMfan

Rock n' Roll Doggie VIP PASS

It spends more than it receives in revenue.

There is only an IOU in the Social Security "lockbox."

The unfunded liability of Soc sec is $10 trillion.

Run a pension plan like that in the private sector and you'd be in jail.

And Europe faces the same demographic problem of funding its Welfare state.

A lot of people spend more money than they make, are they Ponzi schemes too?

Clearly SS is unfunded that far out in the future, but it can always be funded. A Ponzi scheme is inherently unfunded because it's never designed to be funded.

U2DMfan

Rock n' Roll Doggie VIP PASS

Of course, higher and higher taxes. It's so easy.

We've had one federal tax increase in the last 20 years. And that just happened recently and it only affected people making nearly half-a-million dollars a year. We can survive another increase on the SS tax cap.

Such an increase would only apply to people making well above 100K a year. And no, it's not fair that they'd have to pay more. But many kids born into poverty have almost no chance of ever getting out of it. It's possible, but it's extremely difficult and the odds are against it. Is that fair? No.

So, as I've heard my whole life, growing up in Red State America, surrounded by fiscal conservatives that believe in personal responsibility. "Life's not fair. Get over it."

I'm pretty much still a fiscal conservative in principle, I just can't ignore the realities. And I believe very strongly in Social Security as a necessity.

I also believe in paying that bill. How else would you do it?

Do you want to get rid of Social Security? Tell us how you'd fix the problem.

INDY500

Rock n' Roll Doggie Band-aid

We've had one federal tax increase in the last 20 years. And that just happened recently and it only affected people making nearly half-a-million dollars a year. We can survive another increase on the SS tax cap.

Such an increase would only apply to people making well above 100K a year. And no, it's not fair that they'd have to pay more. But many kids born into poverty have almost no chance of ever getting out of it. It's possible, but it's extremely difficult and the odds are against it. Is that fair? No.

So, as I've heard my whole life, growing up in Red State America, surrounded by fiscal conservatives that believe in personal responsibility. "Life's not fair. Get over it."

I'm pretty much still a fiscal conservative in principle, I just can't ignore the realities. And I believe very strongly in Social Security as a necessity.

I also believe in paying that bill. How else would you do it?

Do you want to get rid of Social Security? Tell us how you'd fix the problem.

Adjust the retirement age to account for the longer lifespan.

Allow an opt-out with proof of an individual retirement account.

Crackdown on Social Security Disability fraud. Even 60 Minutes took note of the enrollment explosion of the past 5 years.

That's only 3 things but it's three things more than this administration will do.

Similar threads

- Replies

- 1

- Views

- 285

- Replies

- 7

- Views

- 743

- Replies

- 13

- Views

- 1K

- Replies

- 36

- Views

- 2K