namkcuR

ONE love, blood, life

I thought this was a big enough deal to warrant having its own thread.

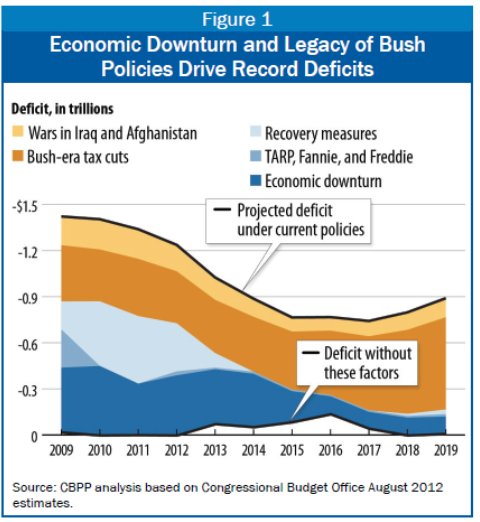

Expiration of Bush Tax Cuts+2011 Budget Control Act Taking Effect(i.e. big across-the-board spending cuts both domestically and on defense)+some other stuff = Fiscal Cliff

The President and Democrats in Congress have made it very clear that they won't agree to any bill that doesn't allow tax rates on the top 1-2% to increase. Even if such a bill were passed in congress, the President would veto. After he extended the Bush tax cuts in 2010, he said he wouldn't do it again, and he won re-election on a platform that made a big point out of keeping his word about that. I believe him.

Congressional Republicans have said they're open to more revenue, but not increasing tax rates, which I guess means they're open to closing loopholes, etc. They soundly rejected the Democrats' opening proposal on Thurdsay, and seem primed to hold the middle class tax cuts hostage.

House Minority Leader Nancy Pelosi threatened to use a procedure called a 'Discharge Petition' to get the bill already passed by the Democratic Senate(which lets the tax cuts expire for all but those making more than $250,000, I believe) on the floor in the House without Speaker Boehner putting it to a vote himself, but it's unclear whether or not she has the votes to succeed.

Some on the left(and those who care deeply about the deficit) - I saw Howard Dean say this on TV this morning - think that perhaps we should go over the cliff, that it might hurt in the short term but be the best thing for the country in the long term because the tax increases and spending cuts would go aways in reducing the deficit and getting us closer to balancing the budget.

Anyway, like I said, I thought it was a big and interesting enough story to warrant its own thread.

Discuss.

Expiration of Bush Tax Cuts+2011 Budget Control Act Taking Effect(i.e. big across-the-board spending cuts both domestically and on defense)+some other stuff = Fiscal Cliff

The President and Democrats in Congress have made it very clear that they won't agree to any bill that doesn't allow tax rates on the top 1-2% to increase. Even if such a bill were passed in congress, the President would veto. After he extended the Bush tax cuts in 2010, he said he wouldn't do it again, and he won re-election on a platform that made a big point out of keeping his word about that. I believe him.

Congressional Republicans have said they're open to more revenue, but not increasing tax rates, which I guess means they're open to closing loopholes, etc. They soundly rejected the Democrats' opening proposal on Thurdsay, and seem primed to hold the middle class tax cuts hostage.

House Minority Leader Nancy Pelosi threatened to use a procedure called a 'Discharge Petition' to get the bill already passed by the Democratic Senate(which lets the tax cuts expire for all but those making more than $250,000, I believe) on the floor in the House without Speaker Boehner putting it to a vote himself, but it's unclear whether or not she has the votes to succeed.

Some on the left(and those who care deeply about the deficit) - I saw Howard Dean say this on TV this morning - think that perhaps we should go over the cliff, that it might hurt in the short term but be the best thing for the country in the long term because the tax increases and spending cuts would go aways in reducing the deficit and getting us closer to balancing the budget.

Anyway, like I said, I thought it was a big and interesting enough story to warrant its own thread.

Discuss.